T4 W5 (6-12 Nov) - Tax!

Section outline

-

Learning Intentions

- To explore how financial information is used to make decisions.

- To explore good practice in spending, saving and borrowing and with a professional.

- Can describe different types of income and tax

- Can describe the ways that taxes are used by the Government.

Introduction to tax

The Government needs to raise funds to pay for public services (eg healthcare, police, nurses, schools) and infrastructure (eg roads, national parks). The main way in which they raise these funds is through taxes. In NZ, just under $100 billion is collected each year.

The main types of tax are:

1. Income Tax (PAYE)

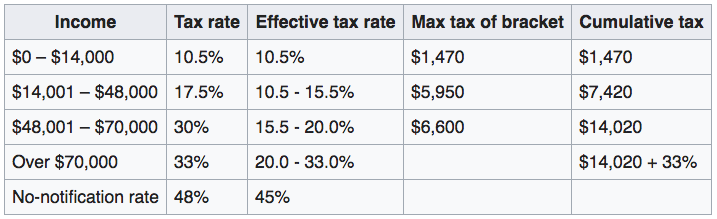

Pay As You Earn (PAYE) is deducted from wages and salaries, before you receive the money. It is a 'Progressive Tax', meaning that if you earn higher income, you pay a higher percentage of your income in tax. We'll discuss the table below, but in simple terms it shows that:

- if you earn $14,000 you pay 10.5% ($1,470). I

- if you earn $14,100 you pay 10.5% on the first $14,000 and 17.5% on the extra $100; that's tax of $1,470 plus $17.50 which totals $1,487.50.

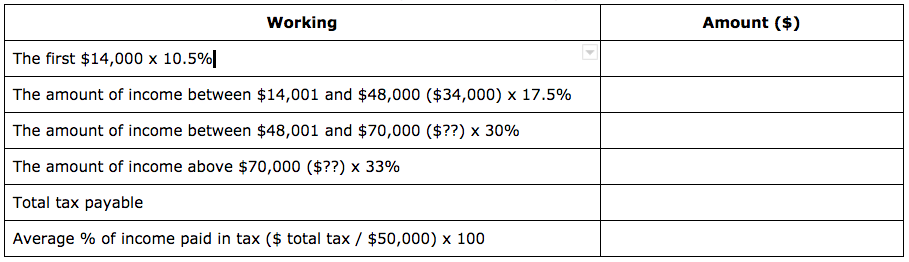

Activity: Calculate the income tax that you would pay if you earned $50,000 pa. The table below will help you.

2. Goods & Services Tax (GST)

Most goods and services that are purchased incur GST at 15%, which is added on to the basic cost of the products (eg if you buy a shirt for $115 in the shop, $100 is for the shirt and $15 is tax that the shop keeper passes on to the Government).

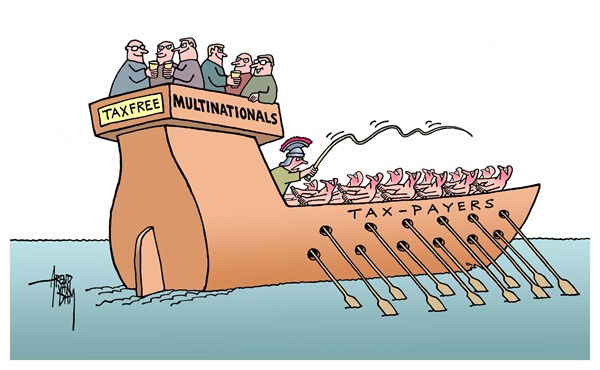

3. Company Tax

Companies pay 28% of net profits as tax. This is a flat rate - large and small profits are all taxed at the same 28%.Activity

1. In small groups, try to explain the 'multinational' cartoon above. Multinationals are companies that operate in several countries.

2. Discuss what might be disadvantages of large multinationals operating in NZ.

3. Discuss any benefits that companies like Google and Facebook bring to NZ

Here are some interesting resources on this topic:

- https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11607336

- https://www.beehive.govt.nz/release/multinationals-tax-legislation-introduced

- https://www.rnz.co.nz/news/political/496826/government-unveils-digital-services-tax-aimed-at-multinationalsIRD numbers and deductions

The Inland Revenue Department issues you a IRD number when you start work - if you ask for one. It's important because they charge a very high 'default' tax rate if you do not have a number. You also need a IRD number if you earn interest or have a KiwiSaver account.

Deductions are made from your income for a range of things. Some are included in the PAYE income tax calculation (eg Accident Compensation or ACC, and student loan repayments). ACC is similar to insurance and pays for health care following accidents that New Zealanders have. Student loans do not have to be repaid until you start working. Your repayments are 12% of any income over $19,136 pa. Other deductions are pension contributions, like KiwiSaver.