Term 4 Week 3

Section outline

-

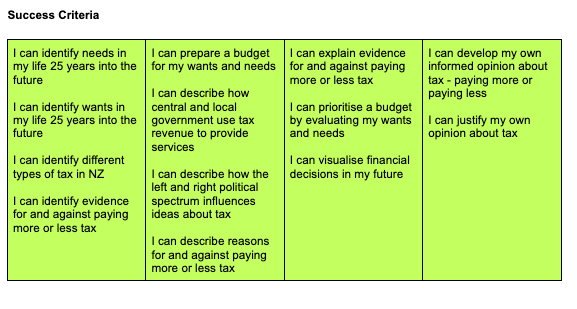

EXPLORE / TŪHURA learning intentions:

- We are EXPLORING...Financial Literacy by…. recognising how the government impacts lives - tax system and goods/services provided

- We are EXPLORING...Financial Literacy by… organising expenditure in relating to wants and need

- We are EXPLORING...Financial Literacy by… recognising fixed expenditure and disposable income

Learning Activities:

For the Math/Global Team Teaching sessions Monday and Tuesday you need to ensure you have applied for a job on Banger High as you will need your salary to calculate your tax.- Tax System BrainPop activity: https://classroom.google.com/c/NDYyNDYxNjQzNzc4/m/NTU5NDczNzUwNDY1/details

- Tax System - podcast (from the 2min 35sec mark): https://www.rnz.co.nz/programmes/news-to-me/story/2018847896/news-2-me-tax Taxes – today is all about money, money, money! You may know how your family buys things, but how does the Government pay for what it does? Who pays your teachers and buys the things to build hospitals and roads?

- NZ Progressive Tax System

https://www.ird.govt.nz/income-tax/income-tax-for-individuals/tax-codes-and-tax-rates-for-individuals/tax-rates-for-individuals - Using your career/job wages/salary on Banqer High and the Tax Brackets above

(Mr Sharma is here to help us !!)

- calculate your progressive tax bill

- you are required to show all working steps - EP - Income tax - challenge task: https://app.educationperfect.com/app/dashboard/homework/7307454

Further Learning ...CAT revision - Global Studies CAT: Week 5

Thursday 17/11/22 Session 1