9 Enterprise 3

Section outline

-

Hi 9ENT3 students,

Please email me at isuckling@mhjc.school.nz if you have questions about any part of the course.

Alternatively, you can find me in Mountains Whanau any time.Mr Suckling :)

Outline of topics- Team building - stages in forming a high performing team

- Social Enterprise - what is it and why?

- Curiosity - generating questions with the question grid

- Entrepreneurs - skills & attributes for success

-

Learning Intentions:

- Consider how to build a team (not just a group)

- Understand that diversity in a team is a strength

- Identify the outcomes we want from the course

Success Criteria:

- We all know the name of each student in the class!

- We have all worked with a variety of students to solve problems

Activity:

Imagine your small group is a project team at a Human Resources firm.

A client (Mr Suckling) wants a 20 minute 'product' that will help him and his 9ENT3 students to learn the names and Whanau of every student in the class. You must bid for the work against other groups.

The 'Brief':

- The 'product' must be fun, simple and certain to be effective (ie everyone knows everyone's name).

- The 'product' can be a document, activities, memory tool, etc.

- If successful in the tender process, the class will use your 'product' to learn students' names and Whanau.

- Time is short. You have:

- 20 minutes to design the product;

- 1 minute to pitch to the client;

- 20 minutes to deliver the product (if your bid is successful). -

Learning Intentions:

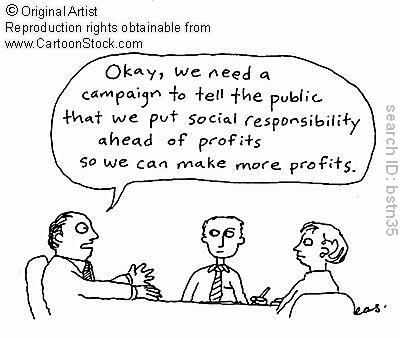

- To investigate the meaning of Social Enterprise

- To identify the outcomes we want from the course

- To develop curiosity and to generate different types of question

Success Criteria:

- We can describe what's meant by 'social enterprise' and can give local examples.

- We can match questions to the 'Question Quadrant' and can use this to identify what we want to learn in 9ENT3

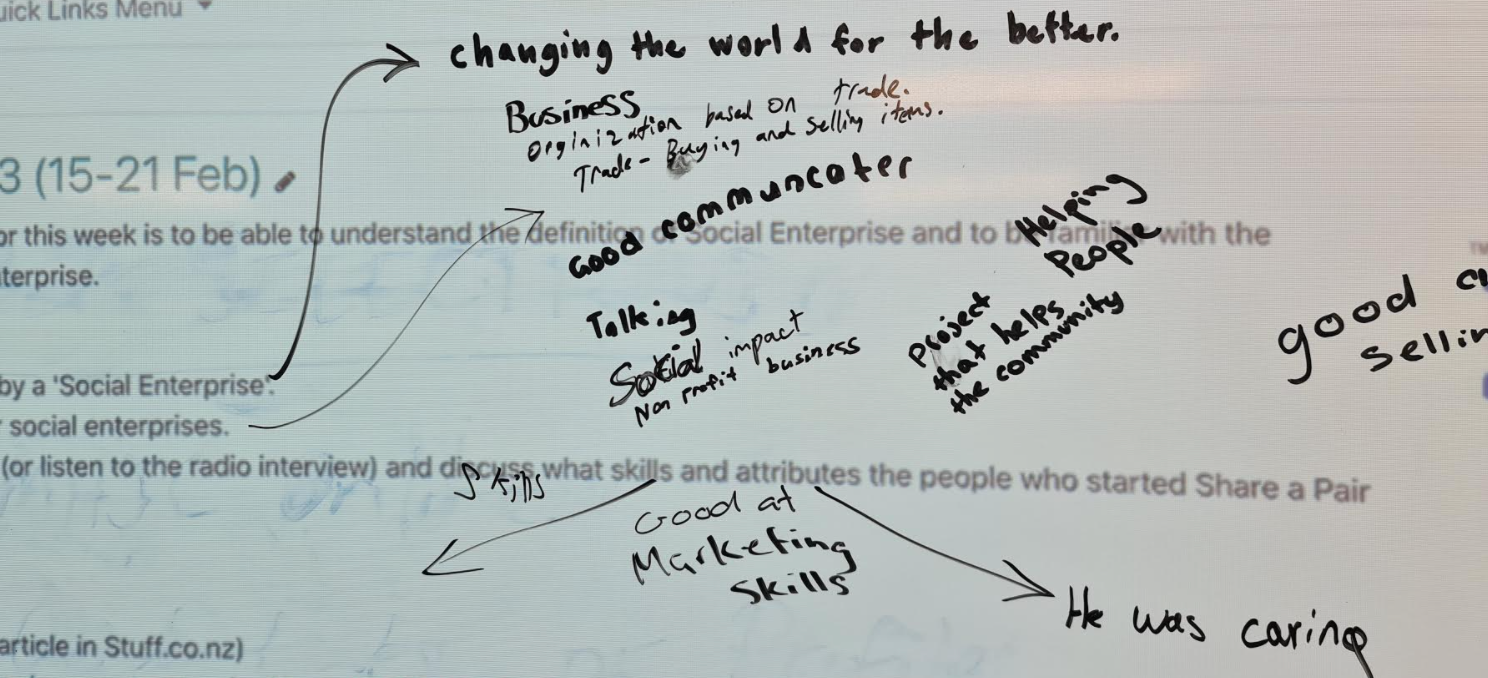

In your small group,

- decide what is meant by a 'Social Enterprise'.

- find examples of other social enterprises.

- read the article below (or listen to the radio interview) and discuss what skills and attributes the people who started Share a Pair demonstrate.

- Look at the examples of Auckland social enterprises (link below) and discuss in your group which ones you most admire or like.Resources

- Share a Pair charity (article in Stuff.co.nz)

https://www.stuff.co.nz/manawatu-standard/news/300214311/putting-shoes-on-the-feet-of-children-in-need - Share a Pair charity (radio item on RadioNZ)

https://www.rnz.co.nz/audio/player?audio_id=2018781201 - Examples of Social Enterprises in Auckland

https://thespinoff.co.nz/business/05-10-2017/a-guide-to-the-top-social-enterprises-in-nz-right-now/

Generating Questions

Students who have left MHJC, say that it's important to know how to ask questions in order to get the help they need and to guide their research.

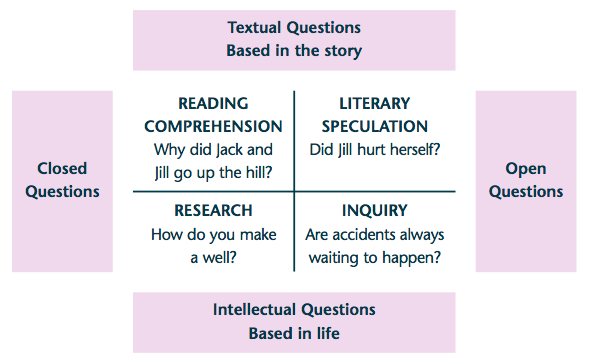

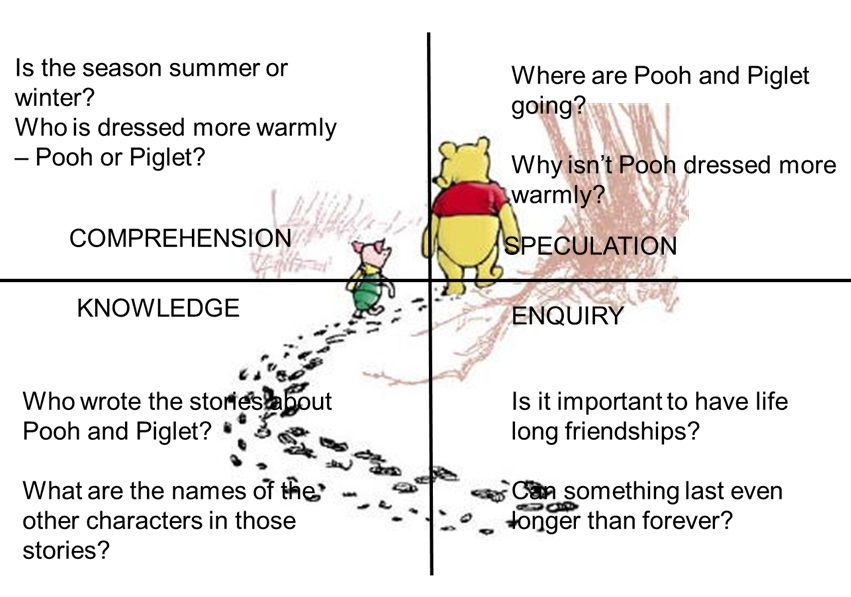

We're learning to use the 'Question Quadrant' to generate different types of question from news articles.

Look at the picture of Pooh & Piglet. Generate questions and write them on post-it notes.Here's an example of the Question Quadrant (and an example using a picture of Winnie the Pooh and Piglet!)

.

.

Comprehension questions have their answer in the story, photo, video

Research questions have their answer in wider research eg on the internet

Speculation questions can be answered by using our imagination about what might be (related to the text, photo, video).

Inquiry (philosophical) questions can be answered through ethics, logic, metaphysics, epistemology, aesthetics.

Ethics - should people be allowed to buy and sell anything?

Logic - If people act in their own interest, will they ever donate to charity?

Metaphysics - how do people know what something is worth?

Epistomology - how do you know something?What do you want to learn on this 9ENT3 course?

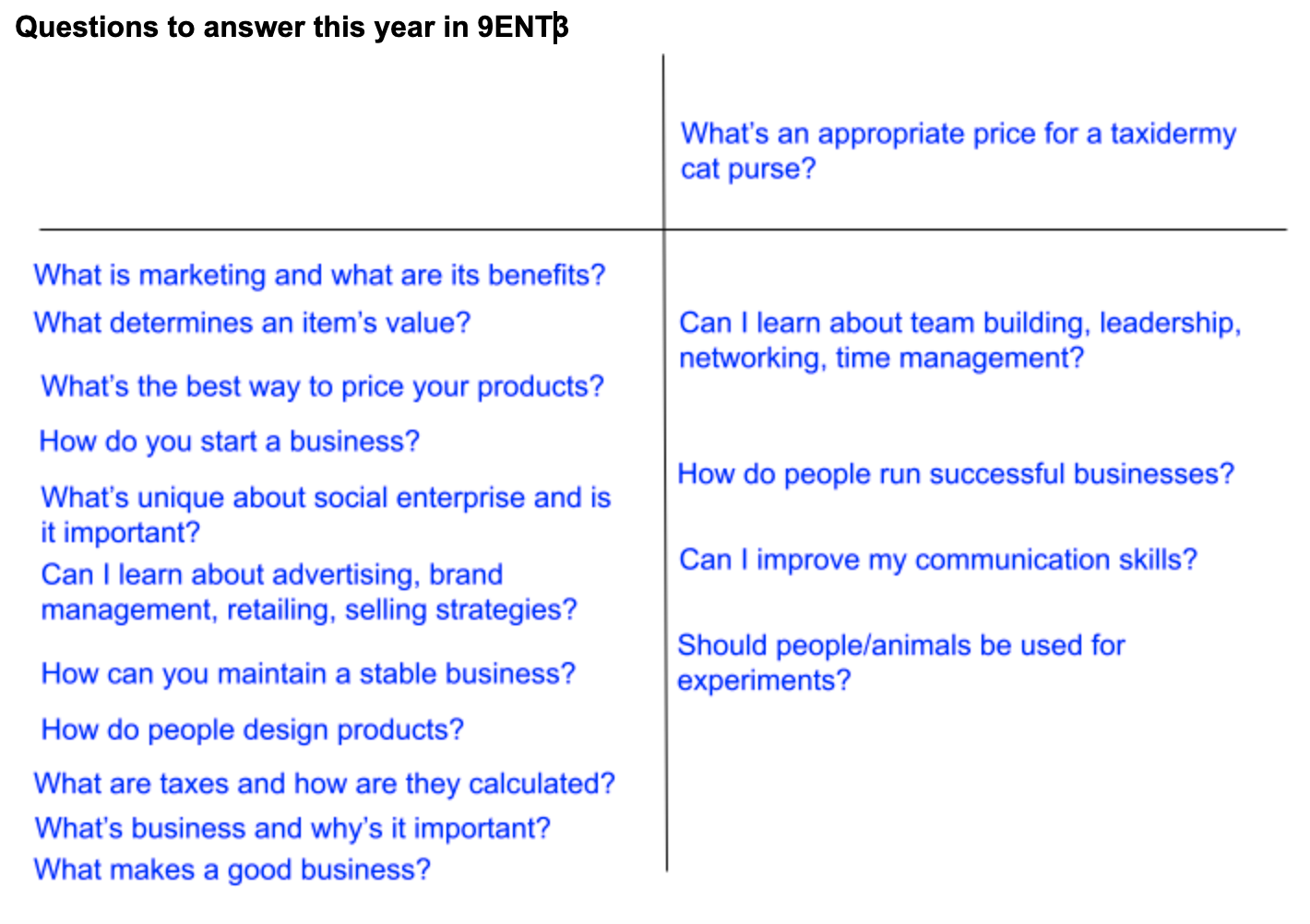

Generate questions about business and social enterprise to identify what you would like to learn in this 9ENT3 course.

Here's a link to some business news items, which we'll use to generate questions based on the Question Quadrant

TradeMe stories: https://www.newshub.co.nz/home/top-10-weird-trademe-stories.html

Young entrepreneurs: https://thespinoff.co.nz/business/18-04-2018/ten-young-entrepreneurs-new-zealanders-should-know-about/

-

Entrepreneurs

Learning Intentions

- Explore examples of enterprising people and their work (local / NZ / global).

- Investigate the skills and attitudes of entrerprising people.

- Explore business purpose/goals/types/examples

- Research pros & cons of business activities (eg multi-national, limited liability)

Success Criteria- We can define an entrepreneur and describe the attributes of an entrepreneur

- We can identify people with entrepreneurial attributes and name examples of entrepreneurial people

- We have identified our own entrepreneurial strengths and areas to develop

An entrepreneur has an idea and risks time, money and reputation putting the idea into action as a business.Activities

- Spend 3 minutes sharing what you know about 'entrepreneurs'.

Then read web resources on enterprising people - find ones who are famous, very young, from NZ, etc.

Share what you've learned that you didn't know before. Discuss whether you think you could be an entrepreneur and why.

Other Resources

List of social enterprise examples https://en.wikipedia.org/wiki/List_of_social_enterprisesPersonality types

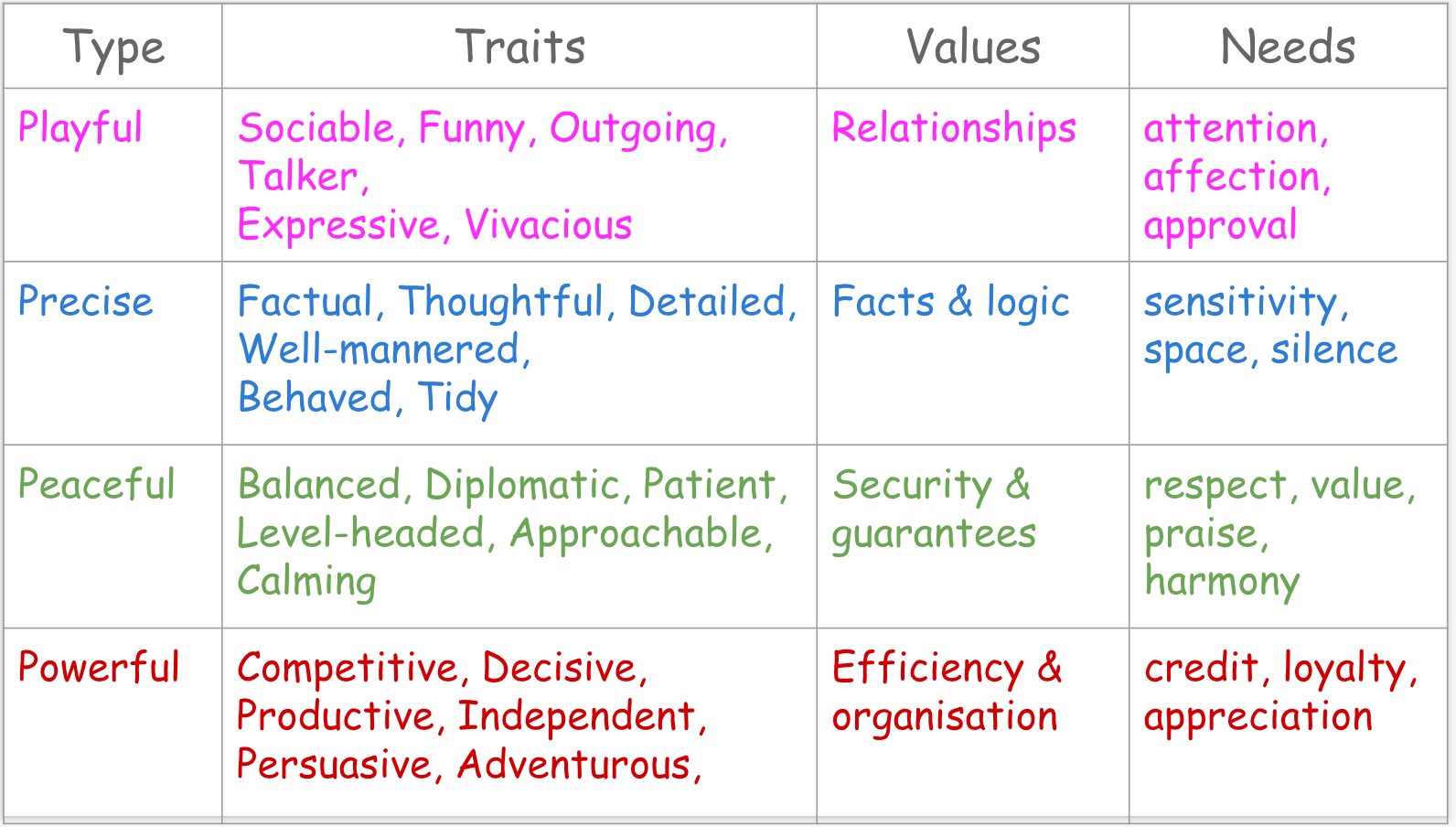

For a team to work well together, it is helpful to understand each other's personality.

One model of personality types suggests that there are 4 main types, as shown below:

No one personality type is better than any other - the theory is that it's best to have a mixture of types.

For example, if all members have 'Playful' personalities, they will have fun, but it's possible that goals are not achieved!

-

Learning Intentions:

- Reflect on how we and others relate to other team members

- Discover the importance of collaboration of individuals for success

- Understand what 'social enterprise' is, and why it's good

- Can describe our own behaviour in teams and our reactions to other members

- Have practised working with different people in order to complete a task

- Can explain what social enterprise is and why it's a good thing

Activities:

- Team activity: Moon survival. Complete the group task in Google Classroom

- Watch this video clip (18 minutes) on social enterprise

- Solar energy entrepreneurs in India (article): https://www.forbes.com/sites/suparnadutt/2017/01/17/solar-energy-entrepreneurs-in-india-are-finding-faster-cleaner-and-economical-route-to-power/?sh=3df5cea86eb8

-

This week, we'll finish analysing our team contributions and how we work with others.

Then we'll apply our learning to solving a real, hands-onLearning Intentions:

- Work as a team to solve a problem (drawing on all the team members' skills & knowledge.

Success Criteria:

- Have planned and worked together to successfully solve a team problem.

Activities:

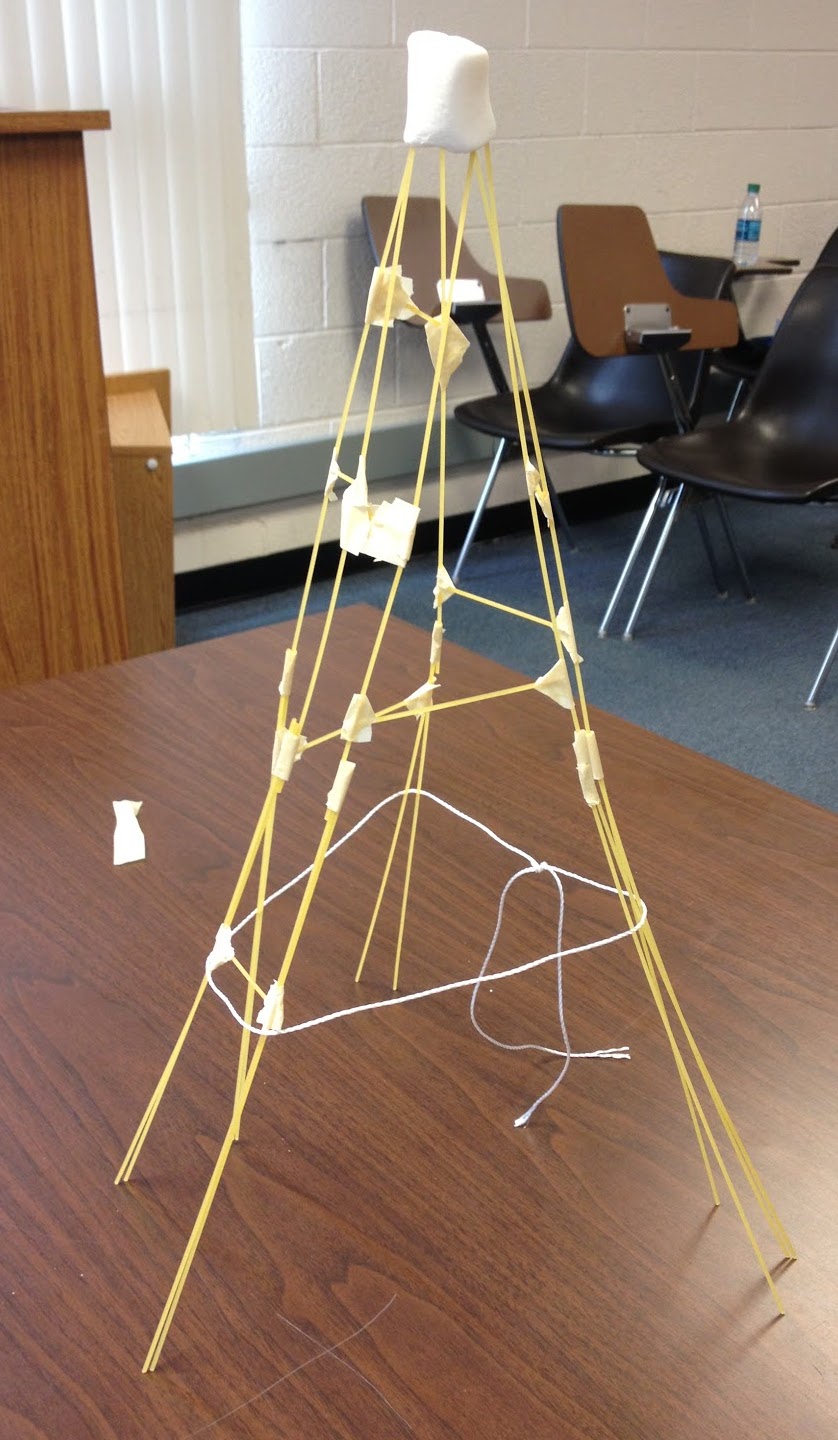

- Make a tower from dried spaghetti and sellotape

The winning team must support an object on their tower higher than any other team. - You have one lesson to complete this.

-

Assessment 1 - Social Enterprise 'product'

We’ve learned about social enterprise, team building, and the skills and attributes of enterprising people. This assessment is a chance to apply this learning to a real-life problem or issue in our community.

Achievement Objectives

• Understand how exploration and innovation create opportunities and challenges for people, places and environments.

• Understand how people participate individually and collectively in response to community challenges.Task Requirements

You are required to produce a product that addresses a community problem or challenge.

The deadline is 3pm on Thursday 6 May 2021

It’s best to:

- work in groups of 3

- ensure any materials used or products produced are environmentally friendly / sustainable. -

Assessment 1 - Social Enterprise 'product'

We’ve learned about social enterprise, team building, and the skills and attributes of enterprising people. This assessment is a chance to apply this learning to a real-life problem or issue in our community.

Achievement Objectives

• Understand how exploration and innovation create opportunities and challenges for people, places and environments.

• Understand how people participate individually and collectively in response to community challenges.Task Requirements

You are required to produce a product that addresses a community problem or challenge.

The deadline is 3pm on Thursday 6 May 2021

It’s best to:

- work in groups of 3

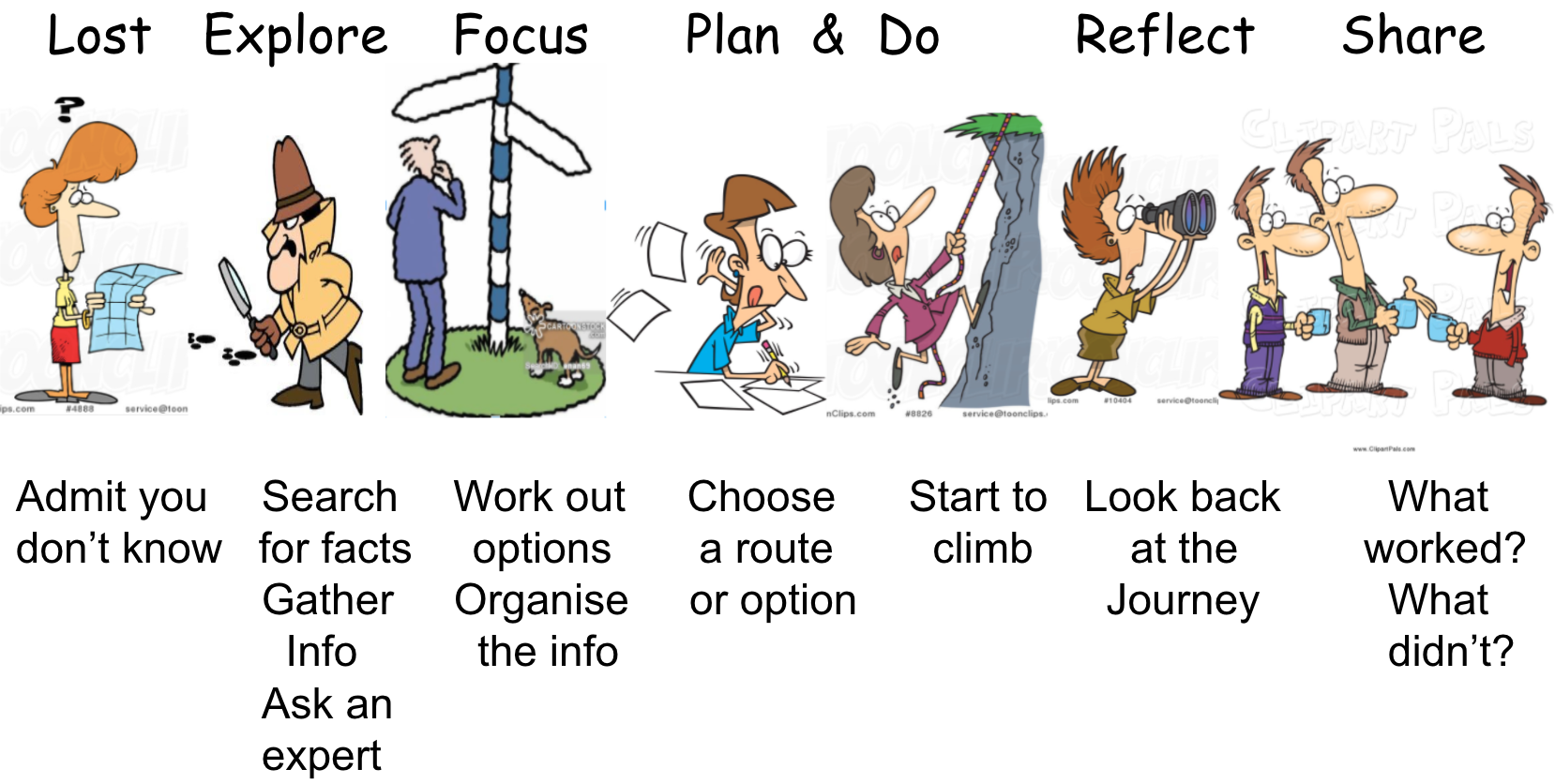

- ensure any materials used or products produced are environmentally friendly / sustainable.Steps to follow

- Watch / read examples of local social enterprise solutions

- Lost: Read these instructions to identify what’s required

- Explore: Gather information on community issues & possible solutions (eg brainstorm, websearch)

- Focus: Organise the information (eg mindmap) and narrow down your options - choose one!

- Plan: Decide and then write down Who? Why? What? Where? When? How?

- Do: Produce the product (good or service) and provide it to people to benefit the community

- Reflect: Discuss what went well, what you’d do differently, the impact you had, etc. Write this down.

- Share: Present to others your ideas, the issue you addressed, the product, your impact, etc.

An example

A community issue might be litter on Flat Bush public grass areas or at school.

Possible solutions could be:

- attractive rubbish bins made of sustainable materials,

- easy to understand signs,

- an education programme,

- a ‘no packaging’ in lunchboxes programme. -

Continue working in your small groups on the assessment (your product that solves a community issue).

Here's the rubric that will be used in marking:

-

-

Students are required to produce a product of their choice in response to a community challenge.

If it is a 'tangible good' rather than a service, it must make use of sustainable materials.

-

-

Learning Intentions

To understand basic vocabulary and concepts of finance and financial literacy

To understand the importance of earning and wisely managing moneySuccess Criteria

This week we'll discover how much we know already about words related to 'finance'.

I am aware of finance vocabulary and have some awareness of their meaning

I can explain what a budget is and why it's important top have one

In Google Classroom there are activities to work on in your groups. -

Learning Intentions

To be able to explain to peers basic vocabulary and concepts of finance and financial literacy

To understand the importance of earning and wisely managing moneySuccess Criteria

I am aware of finance vocabulary and have some awareness of their meaning

I can explain concepts of financially wise decisions, tax, etc Student notes: Being ‘financially wise’ by Skylar, Alan, MaheepPrompts: difference between people who make good decisions about their money and those who make bad ones (good and bad habits - skills, attributes and actions of each type of person). What should you do with your money (savings, investments, spending)? Should you rent or buy a house?

Student notes: Being ‘financially wise’ by Skylar, Alan, MaheepPrompts: difference between people who make good decisions about their money and those who make bad ones (good and bad habits - skills, attributes and actions of each type of person). What should you do with your money (savings, investments, spending)? Should you rent or buy a house? What to do with your money?

- A good habit is to pay all your bills immediately to boost your credit score.

- You could use the 'envelope system' to track expenses (setting aside equal amounts of money into different categories).

- If you have money to spare, put it into an emergency fund, for your family, partner or yourself.

- Save money for your future. If you don’t, you'll have to rely on credit in tough times or work in retirement.

Retiring may be delayed if you're in debt, because you need enough money to make all of your payments.

- Don't make major purchases on the spot. Being pressured into a hasty financial decision is not wise.

All worthwhile opportunities will be there another day if you are patient.Each 'Money Personality' has pros & cons:

The Compulsive Saver: They store away money endlessly as money is the only way to feel secure in life. Friends often come to them for financial advice.

- Cons: does not have as many experiences and are probably introverts to unwatting to spend money

- Pros: Has more money but does not spend it, financially stable almost all the timeThe Compulsive Moneymaker: Believe that earning more money is the secret to happiness and spend most of their energy trying to make as much money as possible.

- Cons: spend time making money so no time for other experiences, yourself, or your mental health.

- Pros: you have a lot of money to spend or save and can buy your way to your idea of happinessThe Gambler: Share traits with Money Makers & Spenders. The thrill of risk & promise of reward is a pleasure.

- Cons: spend all money on the thrill or low chance of winning, financially unstable and live paycheck to paycheck.The Worrier: Lack confidence in own abilities to achieve financial freedom & obsess over the worst case scenario.

- Pros: you live an average, financially stable, middle class life.

- Cons: you never take risks so don't have many interesting experiences and worry about every small detail.The Investor: Invests in things that they hope will go up in value (eg shares)

The Compulsive Spender: Spend money on things you don't need & have an outgoing personality and love treating people to something special.

- Pros: Can secure money & make decisions in companies

- Cons: Can lose a lot of money if they make a bad investment.

- Cons: you spend all your money, you have no money saved

- Pros: you buy many extravagant experiences & items; may have lots of 'friends'

Student notes The ‘Labour Market’ by Ken, Justin, Andre

Prompts: How is the world of work changing? (part-time vs full time work, new types of job, quantity of low paid work and who does it, skills & qualifications needed by school leavers, distribution of income and wealth.

The labour market is where you can find jobs you are excellent at eg if you love cooking you can make a cooking website, like how to cook or make recipes.

A labour market is the place where workers and employees interact with each other. In the labour market, employers compete to hire the best, and workers compete for the best job. Services of human labour are bought and sold like other commodities.

In the labour market there are many people competing to get jobs and some people are offering to get paid lower with the same amount of work and quality of work.

Part-time vs Full time work.

Part time workers have less working hours than a full time job.

Precarious is another word for unsafe or insecure job. Nowadays, precarious work is happening a lot more.Student notes Earning income - Alicia, Ahmed, Ram, Tarek

Prompts: the main types of income, how they work with examples (eg commission, salary, wages) and types of job that receive each, advantages and disadvantages of each income type.

Ways of making income

- Online

- Get a undergraduate job

- Gamble

- Start your own business

- Save money

- Make money properly (By Working)

- Become a trademe seller

- Take paid online surveys

- Start a Service Business

- Become a freelance writer

- Start a service business

- Selling stuff you don’t use any more

- Baby sitDifferent types of Income

Wages are money earned by the hour (more hours worked = more money). It can be unstable.

Salary is a yearly amount earned, paid weekly or fortnightly. It is a fixed and so secure form of income.

Commission is a percentage of the value of the item sold received.

Interest When you put money in a bank account, you receive interest (eg 5%) as a 'thankyou' for using their bank.

Investments

Gifts

Allowance/Pocket Money

Government PaymentsHighly Paid Job examples

Cardiologist - $351,827 a year.

Anesthesiologist - $326,296 a year.

Orthodontist - $264,850 a year.

Psychiatrist - $224,577 a year.

Surgeon - $216,248 a year.

-

Student notes How much people earn - Sabrina, Sarayu, Muskan

Prompts: starting & maximum incomes of different jobs, things that affect income received (e.g. graphs of median income by age, highest qualification, type of occupation), qualifications & time needed to get jobs.How much do these jobs earn?

Physician - A trainee earns about $72,000 per year, Experienced physicians earn from $155,000 to $219,000 per year, and physicians working in private sectors earn up to $600,000.

Teachers - A primary school teacher earns about $50,000 per year (with 6 years experience earn $80,000 per year. 3-4 years of training are required to be a teacher.

Vet - with three years of experience earn up to $83,000 per year (with five years of experience up to $95,000 per year. 5 years of training are required to be a veterinarian.

Nurse - Graduate nurses earn about $54,000 per year. Senior nurses earn about $79,000 to $130,000 per year. 3 years of training are required.

Pilot - earn about $50,000 and $150,000 per year. 2-3 years of training is required.

Judge - earn about $334,000 to $490,000 per year. Judges may also receive an allowance of $4,000 and $6,000. 11 years of training are required to be a judge.

median weekly earnings forms wages(2009-15)

Highest paying jobs in nz low mid high

ceo/managing director-120k 195k 4.5k

Surgeon- 151k 212k 600k

Judge- 334k 413k 490k

Chief Financial Officer-180k 250k 350k

Strategy Manager- 200k 230k 350k

country sales manager-190k 250k 300k

IT General Manager- 185k 250k 300kStudent notes Tax - Mayday, Sanai, Sofee, CLAIRE, Probably (Maidah, Syna, Sophie, Chentian, Parab)

Prompts: Why pay tax and who pays it, different types of tax, how much do we pay in tax, do multinational companies pay a fair amount of tax?, what do IRD, PAYE, GST, net and gross income mean?What is Tax - Tax is a fee that is paid towards the government by people

Why pay for it? - Taxes are crucial because the government collects the funds and utilizes them for financial projects to fund public services (e.g. school, hospitals, teachers, doctors, roads, army).

How much tax do we pay:

As of 2021 the nz tax rate is 10.5% up to a certain income amount. Higher rates are paid on higher amounts of income.7 types of taxes are income tax, sale tax, excise tax, inheritance tax, property tax, payroll tax, and gift tax.

Income tax is money that the government takes out of your earnings. The government use it to fund public services, and pay government obligations to provide goods for citizens.

Excise taxes are imposed on various goods, services, and activities. Such taxes may be imposed on the manufacturer, retailer, or consumer, depending on the specific tax.

Unlike estate tax, which is levied on the value and comes out of the decedent's estate, an inheritance tax is paid by a person who inherits money or property of a person.

Property tax is paid on property owned. It is calculated by a local government where the property is located and paid by the owner of the property.

Gift tax is for giving anything of value to another person. For something to be considered a gift, the receiving party pays an amount less than its full value.

Places that don’t pay income taxes are: UAE, Bahamas, Monaco, St Kitts and Nevis, The Cayman Islands

-

Learning Intentions

To understand the importance of budgeting and wisely managing money

Success Criteria

I can explain what a budget is and why it's important top have one.Notes

To help you make good financial decisions, it's important to know how much money you will have to spend and will receive over the next few week/month/year.

A budget is an estimate (guess) of your spending and income over the next period of time. It shows if you will have money left over or will have not enough money.Expenses are 'outgoings' (spending). Some are essential (eg rent, interest) and must be paid and some are discretionary (eg cinema tickets, holiday) and can be delayed until a later time.

In a budget, some expenses are fixed (don't change) over a period of time (eg insurance payments) and some are variable (different each week) eg food and clothes spending).Activity

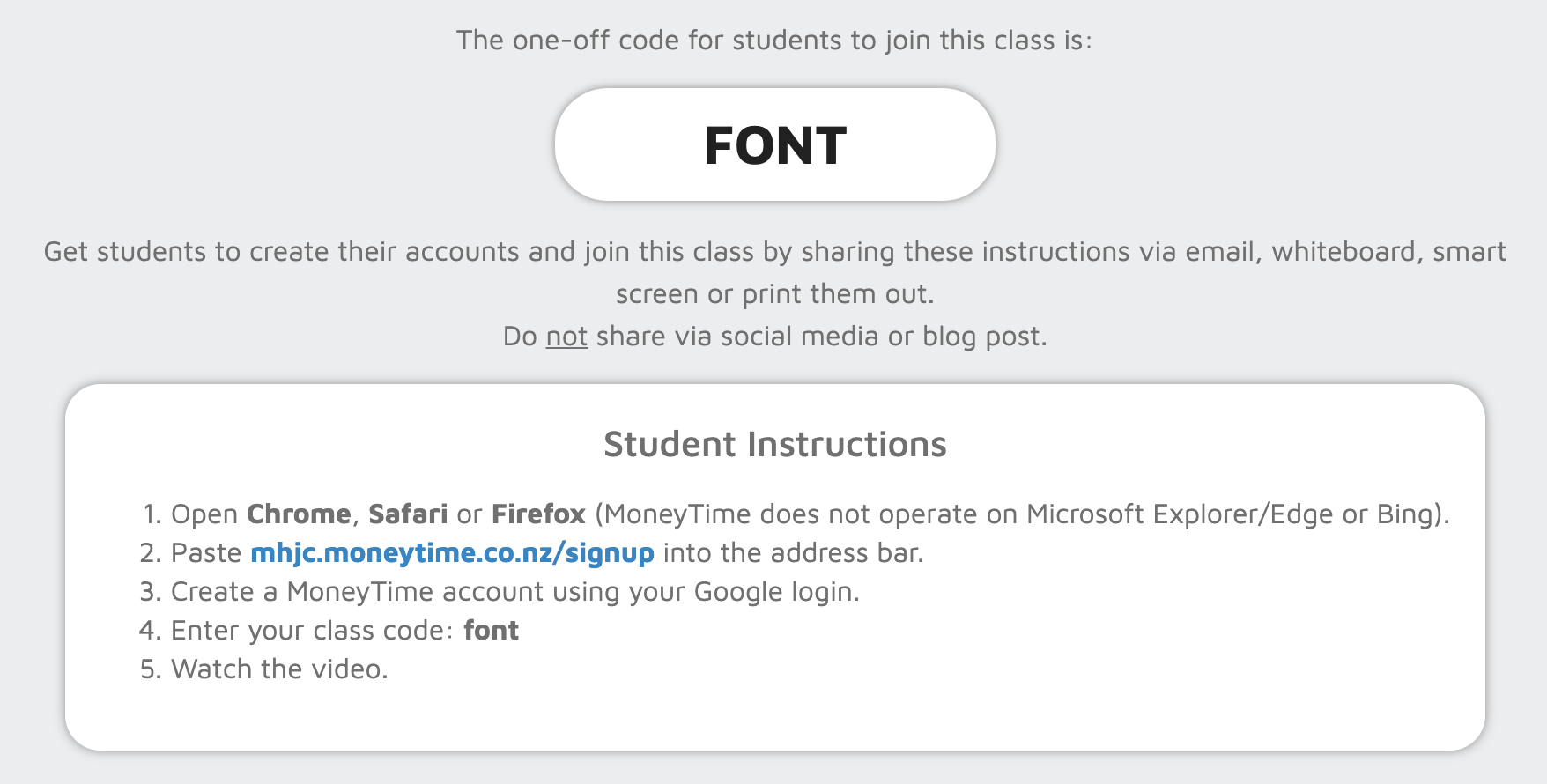

An online activity to help you understand the challenges of having no job or low wages http://playspent.org/Moneytime online course

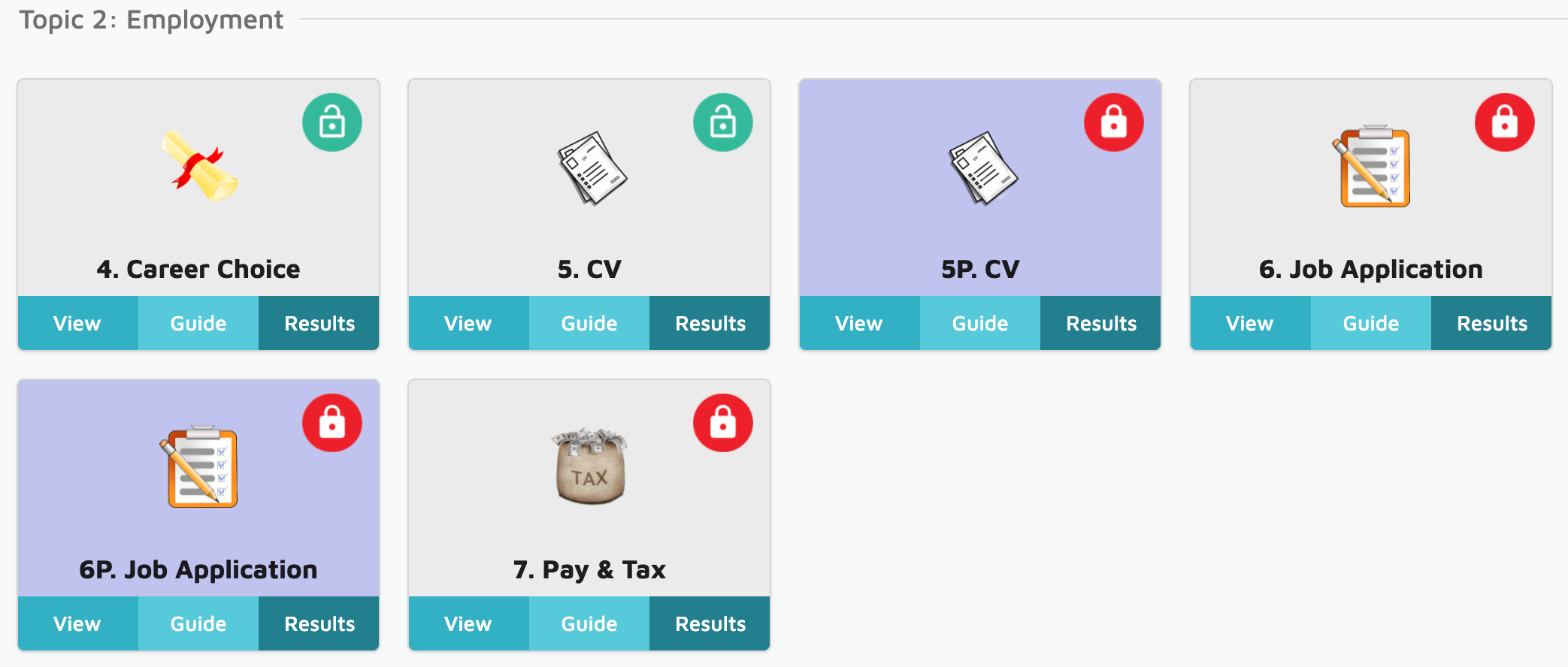

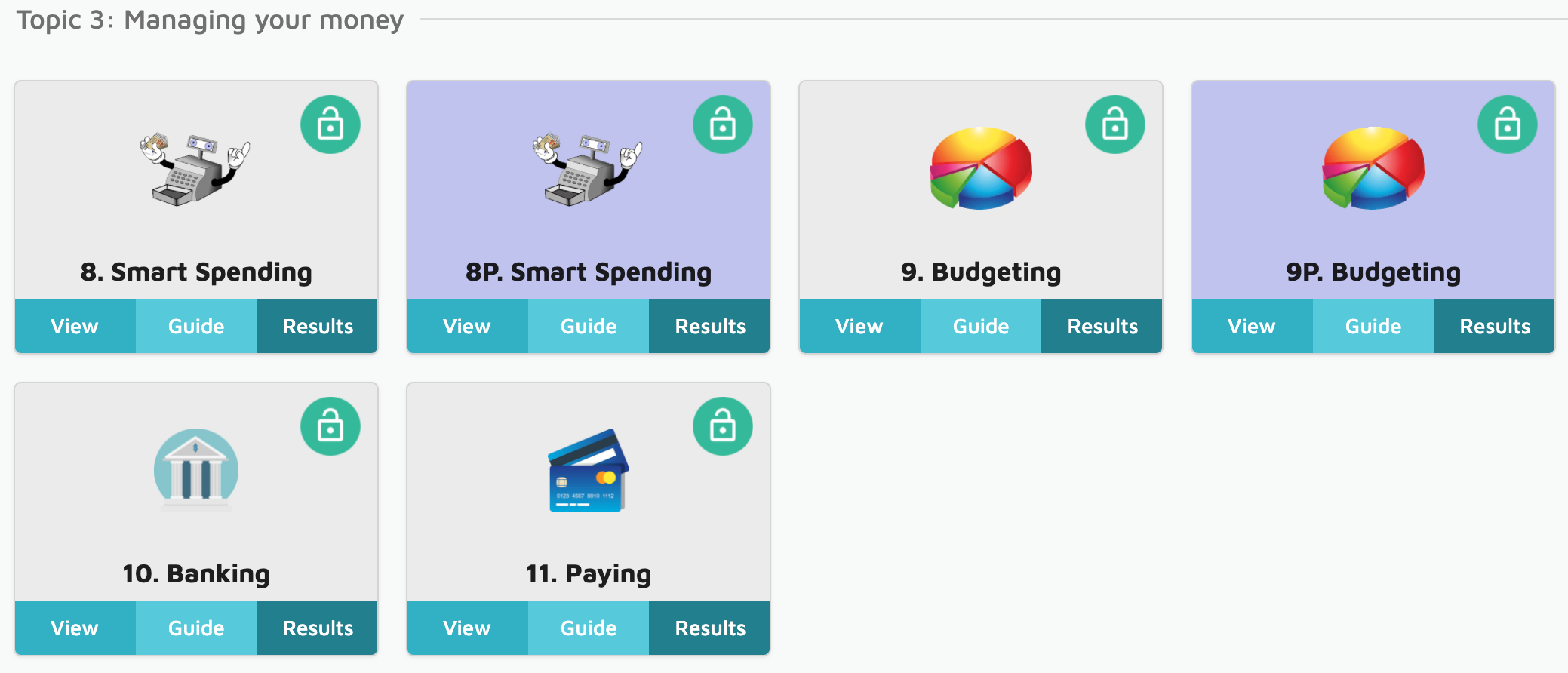

Over this term, we'll be working through activities in the Moneytime online finance package.

Follow the instructions below to register an account.

Activity

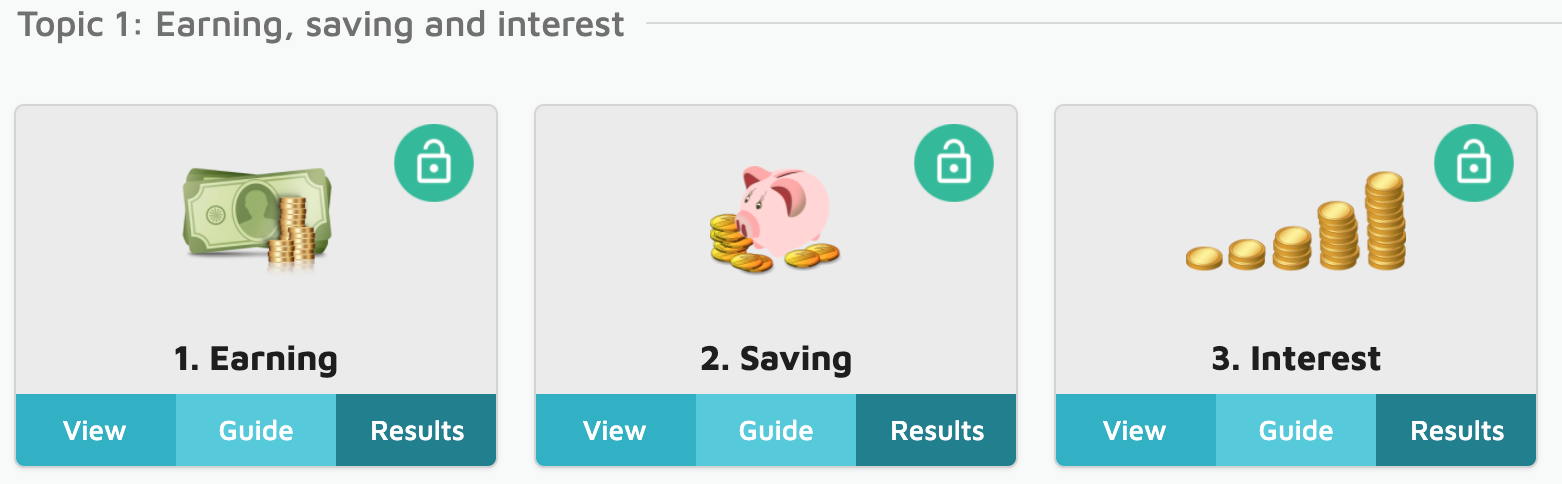

Complete the Moneytime modules on earning, saving and interest:

-

Learning Intentions

To be able to explain to peers basic vocabulary and concepts of finance and financial literacy

To understand the importance of earning and wisely managing moneySuccess Criteria

I am aware of finance vocabulary and have some awareness of their meaning

I can explain concepts of financially wise decisions, tax, etcThis week, I am away and so please continue your work this week on personal finance.

Activity

Complete the Moneytime modules on careers, CVs, job applications, and pay & tax:

When you finish the modules, watch this TEDx talk about a man who traded up from a red paper clip to a house! 'Trading up' is also called 'bartering' and is when you exchange an item for another item (hopefully worth more) and do not use money. This demonstrates entrepreneurship and an awareness of the value that other people place on things.

Here's the link to the video clip (13 minutes):Next week, we'll investigate the impact that technology is having on the world of work.

You might like to listen to the 1st of 3 BBC Radio articles on this topic - use earplugs if you have them (26 minutes). https://www.bbc.co.uk/programmes/w3ct2g7k

-

Learning Intentions

To be able to explain to peers basic vocabulary and concepts of finance and financial literacy

To understand the importance of spending wisely and budgeting, and the role of 'high street' banks.Success Criteria

I am aware of finance vocabulary and have some awareness of their meaning

I can explain concepts of spending, budgeting and banking, etcActivity

Complete the Moneytime modules on careers, CVs, job applications, and pay & tax:

-

Learning Intentions

To be able to explain to peers basic vocabulary and concepts of finance and financial literacy

To understand the basic concepts of borrowing money (eg principal, interest, mortgage)Success Criteria

I am aware of finance vocabulary and have some awareness of their meaning

I can explain basic concepts related to borrowing money through loans.Activity

Complete the Moneytime modules on loans and interest.

-

Learning Intentions

To be able to explain to peers basic vocabulary and concepts of finance and financial literacy

To understand the basic concepts of property and mortgages, including renting or buying decisions.Success Criteria

I am aware of finance vocabulary and have some awareness of their meaning

I can explain basic concepts related to property and mortgages.Activity

Complete the Moneytime modules on property and mortgages.

-

Learning Intentions

To be able to explain to peers basic vocabulary and concepts of finance and financial literacy

To understand the basic concepts of investing (eg in bank deposits, property and shares).Success Criteria

I am aware of finance vocabulary and have some awareness of their meaning

I can explain basic concepts related to investing.Activity

Complete the Moneytime modules on property and mortgages.

-

Kia ora 9ENT3 students,

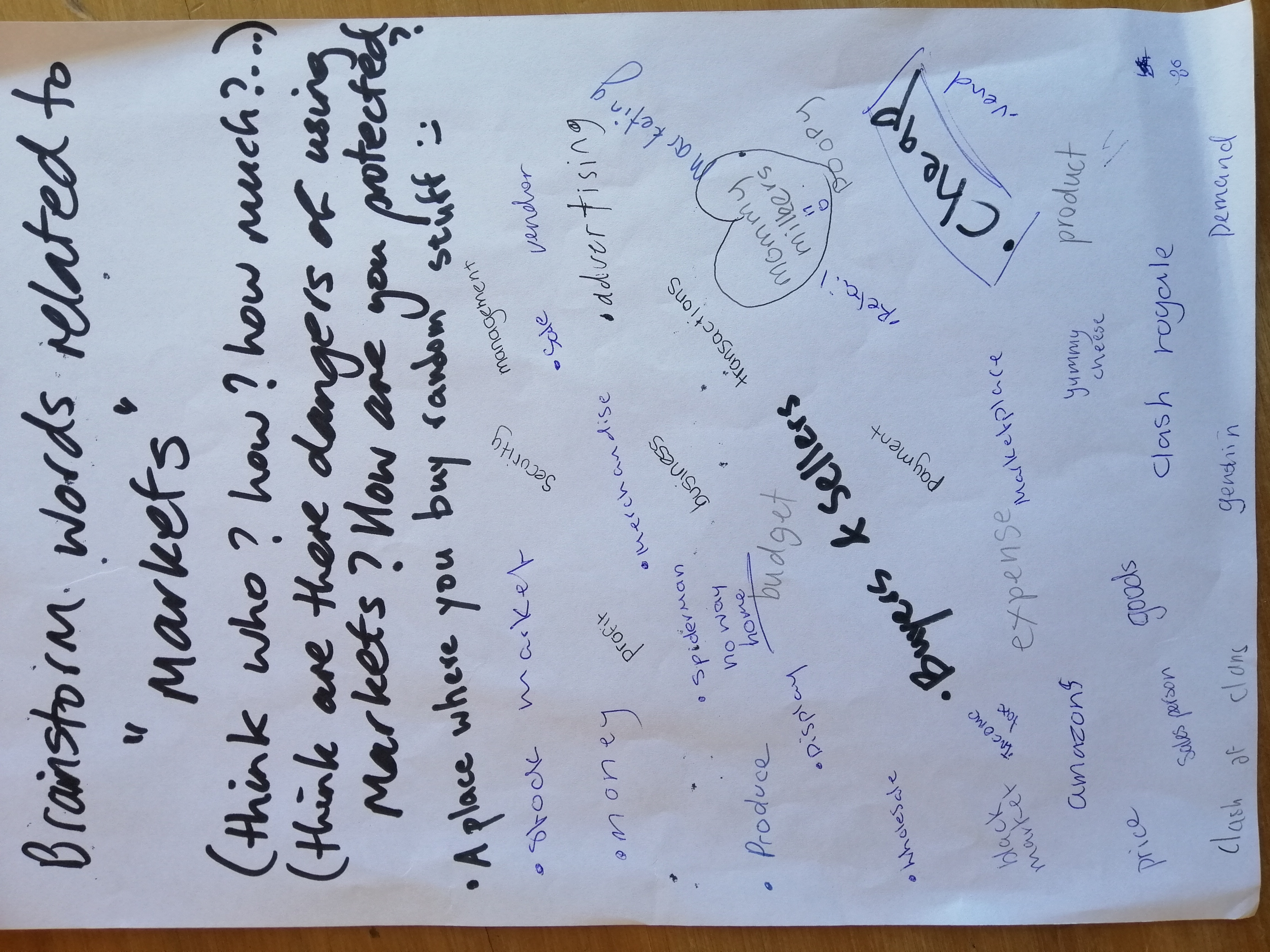

We're starting to prepare for Market Day in Week 10.

Learning Intentions:

To investigate the meaning of concepts and terms related to 'markets'.Understand what is target audienceSuccess Criteria:

I can describe different types of markets.

I can explain key terms related to 'markets'.Activity

Circulate round the classroom, writing your understanding of the words posted on the walls.

You can search the internet when you are not sure. Words will include: Market, Consumer, Retail, Price, Goods & Services, Profit, Marketing, Consumer Rights, etc.

-

Learning Intentions

To recognise in practice the forces that impact market prices

To understand the challenges of bartering and the benefits to exchange of using 'money'.Success Criteria

I am aware of barter and the role of money in aiding exchange.

I can explain forces that affect the market price of a product.Trading Activity (Skittles)

See GClassroom for full instructions and GDocs to complete.Each student starts with 10 Skittles. There are different numbers of each colour available.

Trade with other students by swapping Skittles of one colour with Skittles of another colour.You may swap different amounts (eg 1 orange with 4 green)

The winning trader will hold all 5 colours and have more Skittles than others with all 5 colours.Questions (in GClassroom GDoc)

1. Reflecting on the Skittles trading activity, state what trends you can see in the different values of the 5 colours.

2. We can think of the exchange values as the price of each colour.

Explain why the values (or ‘prices’) of each colour might be different. In other words, what affects the price of each colour?

3. What is bartering? State whether you were ‘bartering’ when you were exchanging (swapping) Skittles?

4. Why might it be difficult to barter in everyday life (eg at the supermarket, in a clothes shop, taking a bus journey, etc)?

5. What might be an advantage of ‘bartering’?

6. Explain how official money, such as the NZ$, makes trade (exchange) easier?

7. Explain how a ‘Green Dollar’ scheme work? (read https://www.nzherald.co.nz/business/meet-the-green-dollar

8. Explain what Crypto-currency is. -

Learning Intentions:

To investigate the meaning of concepts and terms related to 'markets'.Understand what is target audienceSuccess Criteria:

I can describe different types of markets.

I can explain key terms related to 'markets'.Activity

Circulate round the classroom, writing your understanding of the words posted on the walls.

You can search the internet when you are not sure. Words will include: Barter, Added Value, etc

-

Learning Intentions

To learn to brainstorm ideas in a group.Success Criteria

I have brainstormed 100 words with my team towards developing an idea for a Market Day product.Activity

See the activity GDoc in GClassroom.

Brainstorm ideas for a product to sell at Market Day in Week 10.It's important NOT to discuss people's suggestions - just write each word down. Even 'crazy' ideas that you think wouldn't work, can prompt good ideas.

-

Learning Intentions

To follow the MHJC learning process.Success Criteria

I can list the stages of the MHJC learning process.The process we'll follow in planning for Market Day is the MHJC Learning Process.

LOST: We've already identified the challenge or opportunity that we face - to sell a product at market Day.

EXPLORE: Last week, your team brainstormed lots of words that are ideas for a Market Day product.

You might have searched the internet or asked family members in order to expand the range of ideas.

Now, you are to 'FOCUS' or narrow down your options into 2 or 3 possible areas of interest.Activity

Group your words together eg rings & necklaces could be grouped under jewellery.Investigate each of the 2 or 3 broad areas. Share the skills and contacts that each group member has.

If you want top make jewellery and someone's uncle can help with welding and metal work, this is a big advantage. -

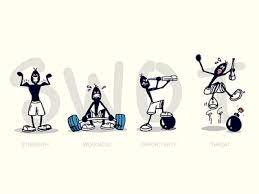

Learning Intentions

To know what a SWOT analysis is, and how and why to perform one.Success Criteria

I have performed a SWOT analysis to identify our product's and our team's competitive advantage over other groups.

Activity

With one product in mind, do a SWOT analysis by writing down things that will enable you to do better or worse than competitors:

Strengths - things inside your team that give it an advantage (eg an Aunt who can help, a team member does a relevant DEEP course)

Weaknesses - things inside your team that give it a disadvantage (eg all members are Peaceful personalities!)

Opportunities - things outside your team that are areas for growth and increased sales (eg the News reports that wearing a steel bracelet is good for you!)

Threats - things outside your team that present concerns and may decrease sales (eg the MHJC Principal may ban all forms of jewellery)

-

Learning Intentions

To know how to plan making and selling a product.Success Criteria

I have planned our product's production, marketing, finances and sales. -

It's still lockdown and in your groups, you are completing the Market Day Journal.

Our GMeet online meetings are an opportunity to ask questions and discuss you ideas.

Here are the sections that you need to write about:Our group

Our Product

Team member roles & responsibilities

Our customer survey to customers

Equipment and planning

Marketing

Finance

Packaging and presentation

Meetings notes and attendance -

Thanks to almost all of you for attending GMeets.

Friday is the deadline for submitting the Journal.

I understand that some groups found it difficult to meet to coordinate your work.

Don't worry about this - it's individually assessed and so you'll each be rewarded for your efforts.

As always, email me if you have questions or problems - we can GMeet if needed. -

Kia ora everyone

Learning Intentions: We are learning to (WALT)...

- Use the 4P'S of marketing and apply this to our Market Day Planning

Success Criteria: I can/have...

- Developed strategies on how to promote my product

- Understand the importance of pricing my product

- Understand that we have competitors and to make our product superior and significant to our competitors

- Understand that our product must be suitable and appropriate for our target audience.

Activities:

- Manufacturing of PRODUCTS in progress

- Advertising should be in progress

- Videos to use as exemplars

-

Learning Intentions: We are learning to (WALT)...

To understand how to incorporate our skills and knowledge to Market day.

To understand the uses of the marketing/advertising processes

Success Criteria: I can/have...

I can apply my skills to the market day planning process

I have understood the different methods of advertising

Activities:

Begin manufacturing market day products.

Complete challenges task/table

Pre market day questions

Promoting and Advertising the stalls

Creation of stall name and logo

-

Kia ora everyone

Learning Intentions: We are learning to (WALT)...

- Understand the overall operations of a supermarket

- understand how producers and consumers exercise their rights and meet their responsibilities.

- understand how people view and use places differently

- understand how people make decisions about access to and use of resources.

Success Criteria: I can/have...

- I have applied the concept of "consumerism" into my supermarket design.

- I have identified different tactics supermarkets and the media use to encourage 'consumerism' and applied them to the layout and design of my supermarket

Activities:

- Final design of supermarket due

-

Kia ora everyone

Learning Intentions: We are learning to (WALT)...

- Participate in a team challenge

Success Criteria: I can/have...

- Work under pressure

- Work in a team environment

- Successfully used the skills fit for a entrepreneur.

Activities:

- Teenage Tech

-