Term 4 Week 4 (2-8 Nov) Psychology of Money & TSB visit

Section outline

-

Learning Intentions

- To explore consumer spending and saving behaviours

- To explore how businesses use our emotions and values to encourage increased spending

- Able to explain consumer and business behaviours regarding spending and saving

- Can share examples of how our money decisions may be influenced and not always be conscious.

The psychology of money

This area of learning will be led by you. Your challenge is to investigate an area of interest within psychology that relates to spending, saving and the actions of consumers and companies.

Values and beliefs

Your use of money (what you spend it on and how much you spend) says a lot about your values, beliefs and what you think is important in life. Things that you may think are important are: caring for the whole community, looking your best, perceived social status (impressing friends and neighbours), education, looking after yourself and not others, fun and living for the moment, travel, family, friends, etc.

Things that you might like to investigate in this area are: what do your, and your family's, use of money say about you? How does your family differ from others in NZ (eg how much does the average household donate to charity or spend on food or restaurants or savings each year )?

Emotions and money

Advertisers are experts at "pressing our buttons" and appealing to our emotions. Often, we don't even think about what's happening and change our behaviour automatically (and spending our money accordingly).

Things that you might like to investigate are: What emotions are specific adverts on TV, online or in magazines trying to evoke? How effective are their attempts? Which types of company appeal to our emotions of fear, desire to be loved/recognised/respected, loneliness, sadness, anger, shame, not belonging, etc?

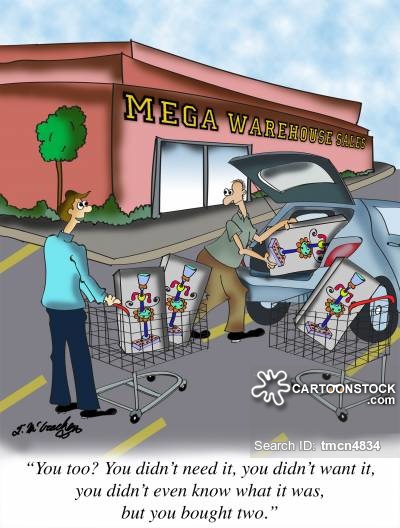

Impulse buying

Impulse buying is unplanned and on the spur of the moment. Supermarkets are good at encouraging us to walk out with many more items than we planned to buy. They do this with large trolleys, discounts and Point of Sale material, positioning of items at isle-ends, free tastings, lots of food and entertainment in malls to keep you there longer, etc. Sometimes, people get home and soon reallise that they don't need or want what they have purchased! This especially happens when on holiday. It can lead to people feeling guilty or getting into financial difficulty. Having a shopping list and sticking to it has been shown to stop impulse buying!

Things that you might like to investigate are: Research real examples of 'tricks' (strategies) used to encourage impulse buying. Ask other students what they or their family have purchased in this way. Why might people buy things that they don't need?

Spaving

Spaving is spending to save, which means that you buy something because it's discounted and so think that you are getting a product for a bargain. The problem is that you may not have been going to buy the item in the first place and so, really, you could think of the discounted amount paid as being spending that you should not have made! This is different to reallising that you really need an item and consciously going out to research and buy the best deal.

Things to investigate: Research 'discounts' - the law about them, how effective they are, examples of unusual product discounts, etc.

Retail therapy

You know what this is - sopping to make yourself feel better! People say "I just needed cheering up, I deserve it, you only live once, it's ok just this once, etc".

You could investigate: what is meant by consumerism? Why George Bush said that the most patriotic thing Americans could do after '9/11' was to go buy things at the shops! What did people do to 'cheer themselves' before consumerism and shopping mall culture. Why might 'retail therapy' be problematic for some people?

Avoiding the pitfalls!

Avoiding the pitfalls!Earning money is not easy - your time and skills are valuable. Looking after your money and being careful how you use this 'limited resource' is important. You could: Pay yourself first (by saving eg Kiwisaver), Be aware and thoughtful about what you buy (do I need it, can I afford it, why am I really buying it), Avoid watching adverts!, Budget and record spending, Be aware of habits that you have formed that have you spend without thinking, etc

You could investigate: budgeting advice websites, compare how much you save each week with other students.

Kiwis' spending and saving habits: https://www.westpac.co.nz/kiwis-spending-and-savings-habits-revealed

Activity

On Google Classroom, there are links to episodes of Nigel Latta's TV series "Mind over Money". In small groups, watch a 20 minute episode and summarise the main points in the document provided. This enables others, who do not watch the episode to learn from it. The link is below:

Having self control is the secret to becoming wealthy - Here's a Stuff article that explains this:

Mind over Money episodes link https://www.tvnz.co.nz/shows/mind-over-money/episodes/s1-e1

Guest presenters from the TSB Bank

Here's the slide presentation for the visit (click it to open). Your preparation beforehand is to think of questions that you want answered.